High Efficiency Air Conditioner Tax Credit

This includes heat pumps central air systems boilers water heaters and more. R22 refrigerant has been banned in America meaning old AC units will eventually have to be replaced with.

Xcel Energy Cooling Rebates Minnesota Heating Air Conditioning

And an air source heat pump must meet or exceed 15 SEER and 125 EER and 85 HSPF in order to qualify for the tax credit.

High efficiency air conditioner tax credit. The government wants you to be more energy efficient and use less electricity as well so they have their own benefits for switching to a new furnace or air conditioner. Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for this tax credit. Or a specific amount from 50 to 300.

Federal Tax Credits. Air conditioners with the designation of ENERGY STAR Most Efficient meet the tax credit requirements. Water heaters natural gas propane or oil Biomass stoves qualified biomass fuel property expenditures paid or incurred in taxable years beginning after December 31 2020 are now part of the residential energy efficient property credit for alternative energy equipment.

500 maximum for all improvements. High-efficiency water heaters furnaces boilers heat pumps central air conditioners building insulation windows roofs biomass stoves and circulating fans used in qualifying gas furnaces. Advanced Main Air Circulating Fan.

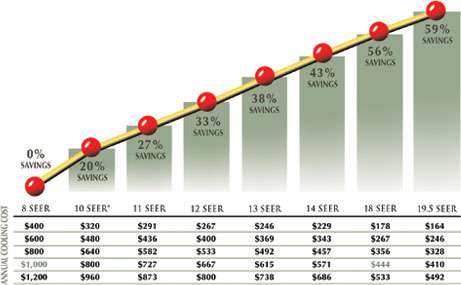

See all requirements here. Kentucky State Tax Credit for Energy Improvements. Air conditioners must have a SEER Seasonal Energy Efficiency Ratio of 16 or higher to qualify.

So making smart decisions about your homes heating ventilating and air conditioning HVAC system can have a big effect on your utility bills and your comfort. The federal tax credit of 500 applies when hitting that same 16 SEER air conditioner efficiency combines with a 95 or greater efficient gas furnace. The 25C tax credit includes.

Other programs offered include low cost home energy assessments free assistance for installing energy efficient products such as shower heads and pipe wrap as well as rebates up to 1900 for solar and home heating equipment and installation. The Federal tax credit for high efficiency HVAC systems is an excellent scheme that you should undoubtedly take advantage of. Appliance retirement incentives pay cash for old fridges air conditioners and freezers.

On top of that Indiana now offers the below rebates of up to 1000 per household until the budgeted 61 Million runs out. Split Systems must have an HSPF Heating Seasonal Performance Factor of at least 85 an EER Energy Efficiency Ratio of at least 125 and a SEER Seasonal Energy Efficiency Ratio of at least 15. Tax credits are effective for all qualified energy property installed from January 1 2018 through December 31 2021.

40 for each window door or skylight you replace. Reimbursement of up to 10 of the cost up to 500. Internal Revenue Service IRS is now providing Consumers with a tax credit on high-efficiency heating and cooling equipment.

The government wants to encourage consumers to purchase high efficiency products for their homes. Government in December 2019. Indiana Residential Energy-Efficient Appliance Rebates.

Is offering the Home Efficiency Rebate a number of rebates for homeowners across the province and those rebates include. Those credits were renewed by the US. What equipment qualifies for the credit.

Weve been working on a much longer-term reinstatement of the tax credits said Todd Washam vice president of public policy and industry relations for the ACCA. A 300 maximum credit for qualifying high-efficiency equipment. Under the Further Consolidated Appropriations Act 2021 Congress has extended individual tax credits for homeowners who make qualified improvements of higher-efficiency HVAC equipment to their primary residences.

The credits came about in large part due to lobbying from the Air Conditioner Contractors of America. So when you buy Energy Star qualified AC models with high SEER efficiency ratings you may qualify for a tax credit. As of January 2021 the program was retroactively.

Therefore a central air conditioner must meet or exceed 16 SEER and 13 EER. The tax credits may be applied to select high efficiency air conditioners heat pumps and ductless heating and cooling systems. Our goal is to see it extended through.

There has been alot of publicity about the Federal tax credits up to 1500 for high efficiency heating and air conditioning units. Heating Ventilating Air Conditioning HVAC As much as half of the energy used in your home goes to heating and cooling. Must yield an energy factor of at least 20 in the standard DOE test procedure.

Windows and Storm Doors Water Heater Heat Pump Air Conditioner Advanced Main Air Circulating Fan. The information about the Arizona 2020 Tax Credit and Rebate Guide for Energy Efficient AC Unit Installation is provided by Allstate Air Heating LLC. Finally the new law reinstates the lifetime credit caps which disqualify any homeowner who has claimed more than 500 in 25c tax credits since January 1 2005 from any further credits.

HVAC 25C tax credits are available for high-efficiency heating and cooling equipment. Certifies that the models listed here if placed in service after December 31. Heat Pumps Meeting the Following Requirements are Eligible for a 300 Tax Credit.

This is a temporary victory. Heres what you need to know about these tax credits. The Rheem Air Conditioning Division of Rheem Sales Company Inc.

HVAC systems have a fixed amount of 300. Electric Heat Pump Water Heater. Between 500 and 3000 for insulation.

Based on the component purchased and installed homeowners receive a tax credit in either a percentage of the cost up to 500 or a fixed amount from 50 to 300. Ontario Rebates Province-Wide Residential Rebates General energy efficiency rebates. Federal High Efficiency Energy Tax Credits.

As well as being reimbursed for some of the upfront costs of a new system you will also save money in the long run as a new highly-efficient HVAC system costs a lot less to run than other older systems. 15 SEER Packaged electric heat pump that achieves the highest efficiency CEE tier as of January 1 2009 80 HSPF. Air Conditioners and Heat Pumps 300 Tax Credit Split system electric heat pump that achieves the highest efficiency CEE tier as of January 1 2009 85 HSPF.

To verify tax credit eligibility ask your HVAC contractor to provide the Manufacturer Certification Statement for the equipment you plan to purchase. Energy-efficient heating and air conditioning systems. Federal Tax Credits.

Bailey offers several qualifying air conditioners. Up to 150 for achieved air sealing.

Air Conditioners Central Air Conditioning Units Daikin

Weil Mclain Ultra Series 3 Gas Boiler Gas Boiler High Efficiency Gas Furnace Air Conditioner Installation

Top 8 Most Efficient Window Air Conditioners In 2021

Ruud Central Air Conditioner Reviews And Prices 2021

Extended 300 Federal Tax Credits For Air Conditioners And Heat Pumps Symbiont Air Conditioning

Central Air Conditioner Ratings Seer Ratings Explained Easy Ac

Air Conditioning Repair And Installation Engle Services Air Conditioner Condenser Air Conditioner Service Air Conditioner

Mrcool Signature Series Heat Pump Package Residential 3 Ton 14 Seer Central Air Conditioner In The Central Air Conditioners Department At Lowes Com

Highly Efficient Asz14 Heat Pump From Amana

How Much Does A Central Ac Unit Cost The Cost To Install Central Air Broken Down

High Efficiency Home Air Conditioner Lennox El16xc1 Elite Series

Why Does Seer Rating Matter High Efficiency Ac Goodman

Mrcool Signature Series Heat Pump Package Residential 3 Ton 14 Seer Central Air Conditioner In The Central Air Conditioners Department At Lowes Com

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Top 10 Most Efficient Central Air Conditioners 2021

Rheem Air Conditioner Prices Installation Cost 2021

Trane Xr16 Air Conditioner Best Rebate Prices Now

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Posting Komentar untuk "High Efficiency Air Conditioner Tax Credit"